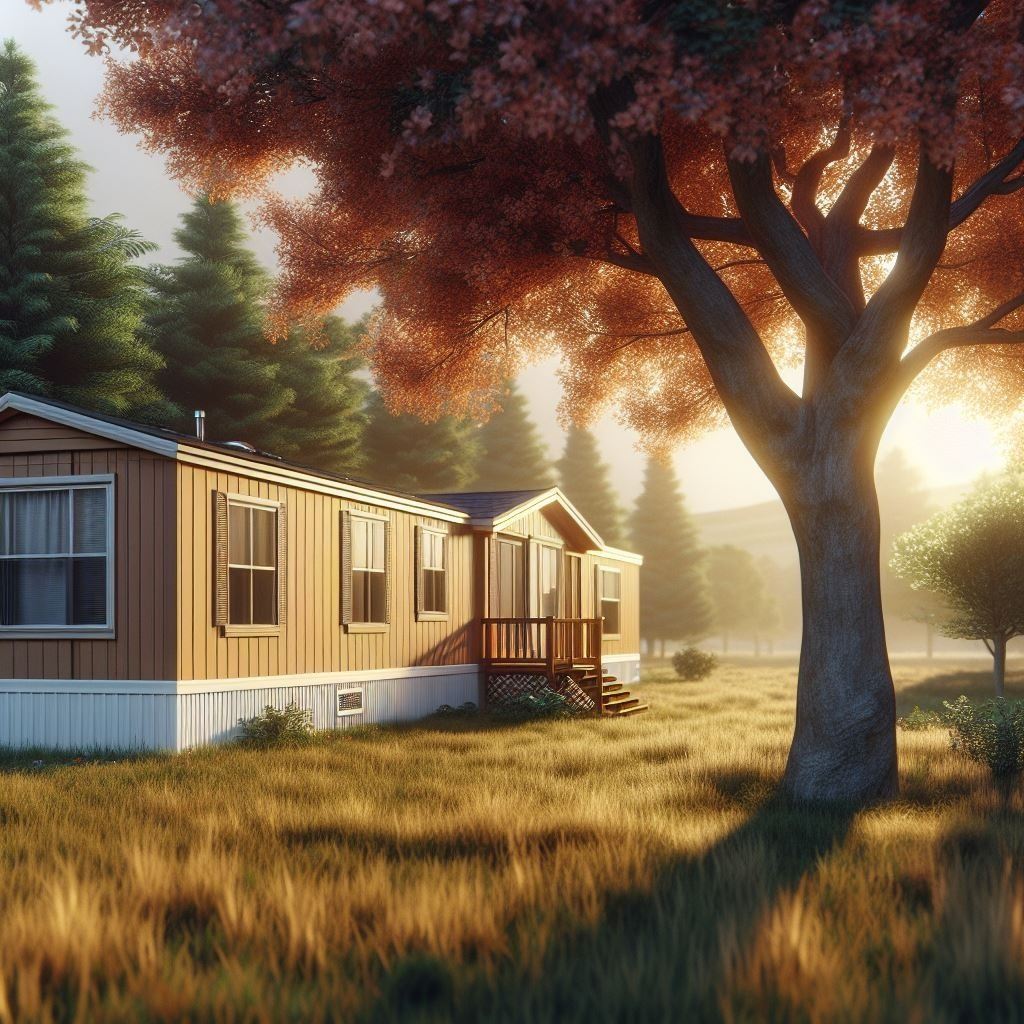

Click here for our free mobile home purchasing guide for the lowdown on how to buy or refi mobile homes

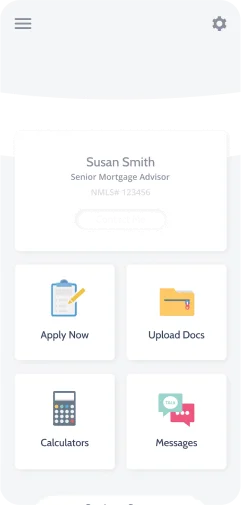

Get started with our secure application. It's a few quick questions that take about 12 minutes to complete.

Our mortgage calculators help you hone in on your future mortgage based on options, interest rates, and more.

Explore various mobile home loan program options for fixed and adjustable rate mortgages.

Property Available

Property Available

7545 Irvine Center Dr., STE 200

Irvine, CA 92618

Phone: (866) 900-6868

sales@smartmoneymortgage.com

The Smart Money Mortgage App guides you through your mortgage financing and connects you directly to your loan officer and realtor.

Find out when an ARM mortgage might be better than Fixed Rate Mortgage

Find out if refinancing is right for you.

Learn about home affordability factors with examples nationwide.

Welcome to Smart Money Mortgage, your trusted partner for all your financing needs! We are the premier mortgage company in California for both mobile home loans and manufactured home loans. At Smart Money Mortgage, we understand that finding the right loan solution can be challenging, and that is why our team of experts are committed to guiding our clients every step of the way. We treat every client like family and provide a personal touch that sets us apart. Your dreams are our priority, and we work tirelessly to find the best financing solution tailored to your unique needs. At Smart Money Mortgage, we truly believe in going above and beyond for our clients.

Located in the vibrant city of Irvine, we are proud to serve the residents of Orange County as well as San Diego County, Riverside County, San Bernardino County, Los Angeles County, Imperial County, and all communities of California. Our team is deeply rooted in these cities and the state, and our extensive knowledge of the local real estate market allows us to offer personalized advice tailored to your specific needs. Whether you're looking for a cozy home near scenic Huntington Beach, a suburban paradise in Anaheim, or the bustling city life of Los Angeles, Smart Money Mortgage has the expertise to make home buying possible.

Your journey to homeownership begins and continues with us. Whether you're a first-time homebuyer or looking to refinance, let Smart Money Mortgage turn your dreams into a reality!

As a family business, Smart Money Mortgage knows the importance of trust, integrity and communication. We offer the warmth of a family-centered approach, combined with the professionalism of seasoned experts. We understand that finding the perfect loan for your manufactured housing needs can be a challenge, and that is why we have chosen to become experts and specialize in manufactured housing. Smart Money Mortgage appreciates the complexity of buying a mobile home in a park where you lease the land or on private property. With our expertise in the manufactured housing industry, we make the process easy and stress-free by committing to our company values:

-In-Depth Education: We empower you with knowledge, ensuring you make informed decisions.

-Trust & Integrity: Your interests always come first. Your trust is the cornerstone of our business.

-Open Communication: We’re always just a call away, ready to answer your questions.

-Cutting-Edge Technology: We leverage the latest tools to streamline the mortgage process.

-Expertise & Experience: Decades of combined experience in the mortgage industry.

In addition to being mobile and manufactured home loan experts, Smart Money Mortgage also specializes in single-family and multifamily property home loans. When it comes to finding the perfect loan solution in California, trust Smart Money Mortgage to be your guiding light.

Smart Money Mortgage has chosen to differentiate itself from other mobile home loan and manufactured home loan companies by becoming experts with all loans, including traditional single-family and multifamily property home loans. We specialize in various loan types, including mobile home loans on leased land in parks or private property, as well manufactured home loans permanently secured to the land. Our single-family home loans include residential home loans, jumbo loans and even commercial loans. Our range of loan programs include:

-Personal Property (Chattel) Loans: Mobile home loans where the manufactured home is on leased land, such as a mobile home park or on private property.

-Conventional Loans: Fannie Mae and Freddie Mac Conforming and High-Balance fixed and adjustable-rate mortgages (ARM), Freddie Mac Home Possible loan, Fannie Mae Home Ready loan for manufactured homes, single-family homes and multifamily properties with up to four units. Freddie Mac HomeOne loan for single-family homes and multifamily properties with up to four units.

-Federal Housing Administration (FHA) Loans: FHA 203b Purchase Loan, FHA 203b Cash-Out Refinance, FHA Streamline Refinance, FHA 203k Standard and Limited Renovation Loans, FHA Energy Efficient Mortgage (EEM), FHA Home Equity Conversion Mortgage (HECM) for manufactured homes, single-family homes and multifamily properties with up to four units.

-Veteran Affairs (VA) Loans: VA Purchase Loan, VA Cash-Out Refinance Loan, VA Interest Rate Reduction Refinance Loan (IRRRL), VA Energy Efficient Mortgage (EEM) for manufactured homes, single-family homes and multifamily properties with up to four units.

-United States Department of Agriculture (USDA) Loans: USDA Section 502 Direct Purchase Loans, USDA Section 502 Direct Refinance Loans, USDA Streamline Refinance for manufactured homes and single-family homes.

-Down Payment Assistance Loans: California Housing Finance Agency (CALHFA) Government loan program and California Housing Finance Agency (CALHFA) Conventional loan program for manufactured homes and single-family homes.

-One-Time-Close (OTC) Construction Loans: New Construction Conventional Mortgage fixed and adjustable-rate mortgage (ARM) for manufactured homes and single-family homes.

-Non-Qualified Mortgage (Non-QM) Loans: Bank Statement and Debt-Service Coverage Ratio (DSCR) fixed rate loans for single-family homes and multifamily properties with up to four units.

-Jumbo Loans: Qualified Mortgage (QM) fixed rate for single-family homes and Non-Qualified Mortgage (Non-QM) fixed rate, adjustable-rate mortgages (ARM) and interest only for single-family homes and multifamily properties with up to four units.

-Home Equity Line of Credit (HELOC) loans: Piggyback (HELOC) Purchase Loan, Piggyback (HELOC) Refinance Loan, Standalone (HELOC) Cash-Out Refinance for manufactured homes, single-family homes and multifamily properties with up to four units.

-Commercial Loans: Multifamily Purchase Loan, Multifamily Refinance Loan for properties with more than four units.

Our dedicated team will assist you with pre-approval, assessing your financial standing, and providing expert advice to help you make the best loan program decision.

To qualify for a mobile home loan in California, lenders evaluate factors like your credit score, income stability, and the condition of the mobile and manufactured home. Additionally, the down payment you can afford to put towards your home purchase will determine what type of home loan you will qualify for. Here are some important facts to consider when determining what type of manufactured home loan is right for you.

-Mobile home loans in California are personal property (chattel) loans specifically designed for purchasing or refinancing mobile homes in parks or on private property that are not permanently affixed to the land.

-Mobile home loans in California are considered alternative lending loans since they are not permanently secured to the land and do not qualify for conventional or government loan programs.

-Manufactured home loans in California are considered mortgages if the home is permanently affixed to owned land, recognized by the county as real property, and do qualify for conventional and government loan programs.

-Interest rates for mobile home loans and terms vary depending on credit history, down payment, mobile home year built and sometimes the age of the borrower.

-Mobile home loans in California located on leased land will require borrower approval by the park to reside in the community.

-Mobile home loans can be purchased with 0% down payment with excellent credit, and even poor or no credit qualify when putting a 35% or greater down payment.

-Manufactured home loans in California can be purchased 0% down payment when qualifying for government down payment assistance programs, although the typical manufactured home loans require a 3.5% to 5.0% down payment, depending on the loan program.

-As experts in the manufactured housing industry, our company can close mobile home loans and manufactured home loans typically within 30 days.

-Mobile home loans do not permit non-occupant co-borrowers while manufactured home loans do permit non-occupant co-borrowers.

Contact us today to schedule a consultation and discover how we can help you secure the perfect loan for your needs.

Smart Money Mortgage – Your Partner in Financing Happiness.