Learn why newly built homes might be your most budget-friendly option.

Published on 07/24/2024

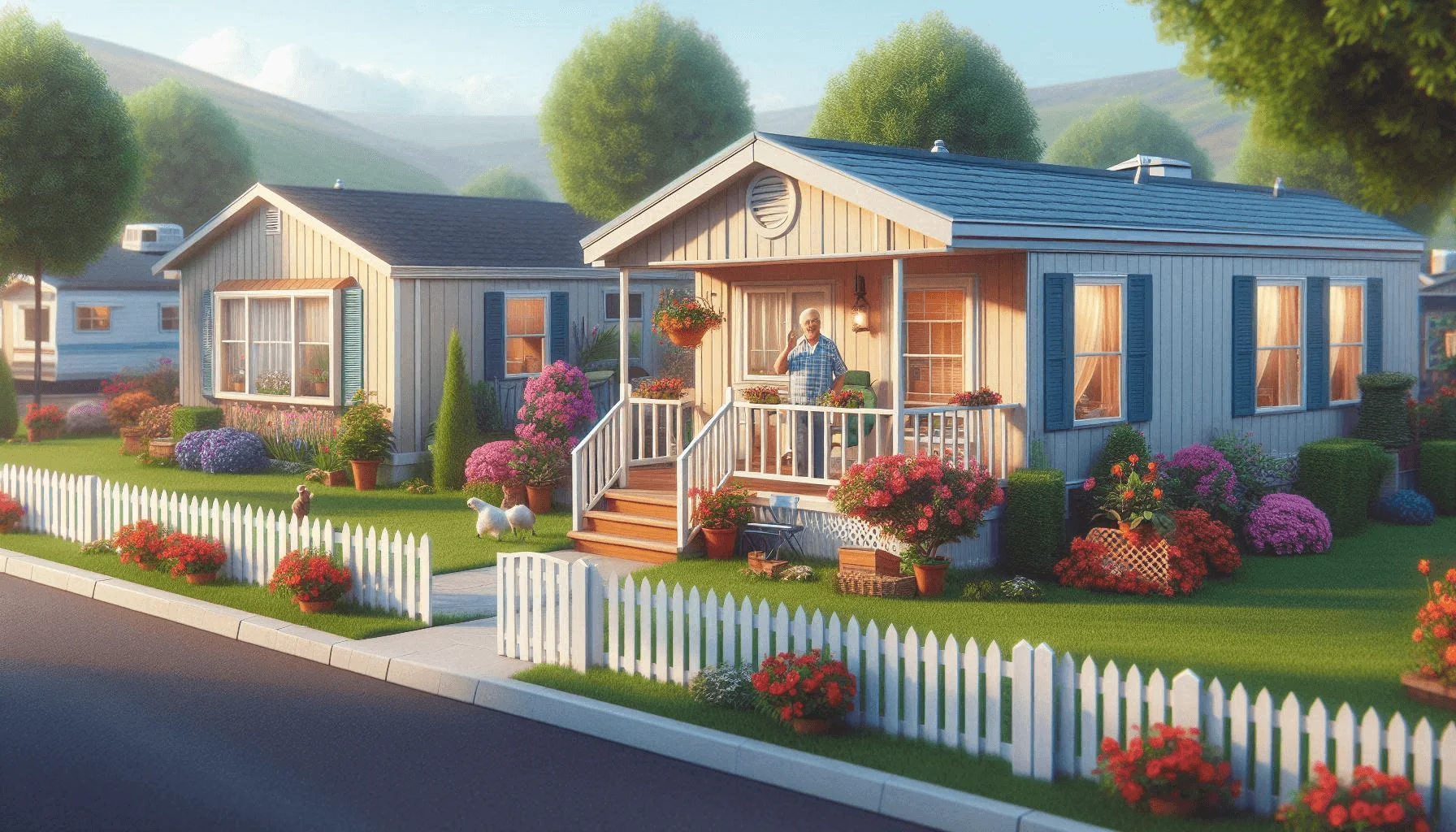

Many homebuyers are turning to financing a manufactured home in a park as an affordable solution to the housing crisis

Published on 07/20/2024

By understanding and preparing for the refinance appraisal process, you can better navigate your mortgage refinancing and potentially secure more favorable loan terms.

Published on 07/17/2024

If you're curious whether your desired neighborhood currently offers favorable conditions for buying a mobile home in California, here are practical ways to determine it.

Published on 07/12/2024

Let'a talk about maximizing your tax benefits with home equity loan deductions.

Published on 07/10/2024

Learn how to use a mobile home loan calculator to estimate monthly mortgage payments for mobile homes in California, the significance of interest rates, and the benefits of making extra payments to shorten the loan term.

Published on 07/06/2024

If you're curious whether your desired neighborhood currently offers favorable conditions for buyers, here are practical ways to determine it.

Published on 07/03/2024

Are you making it harder on yourself to buy a mobile home in California? Read this article to uncover the worst mistakes mobile homebuyers are making.

Published on 06/30/2024

A FICO score is a three-digit number representing your creditworthiness, determined by factors like payment history and amounts owed, and it significantly influences your ability to qualify for and secure favorable terms on home loans.

Published on 06/26/2024